WANT TO READ THE DIY GUIDE?

Enter the FairShares Commons

Why?

I worked in the corporate sector for a decade, and wondered why …. why have decades of CSR, environmental legislation, banking regulation etc. failed to stop climate change, and all our other challenges? I kept asking why, that childlike repetition that used to drive my parents to distraction at times.

Eventually I realised a root cause, one that held our planet trapped in our current dysfunctional economy. One that, unless we broke free, would prevent any initiative from working.

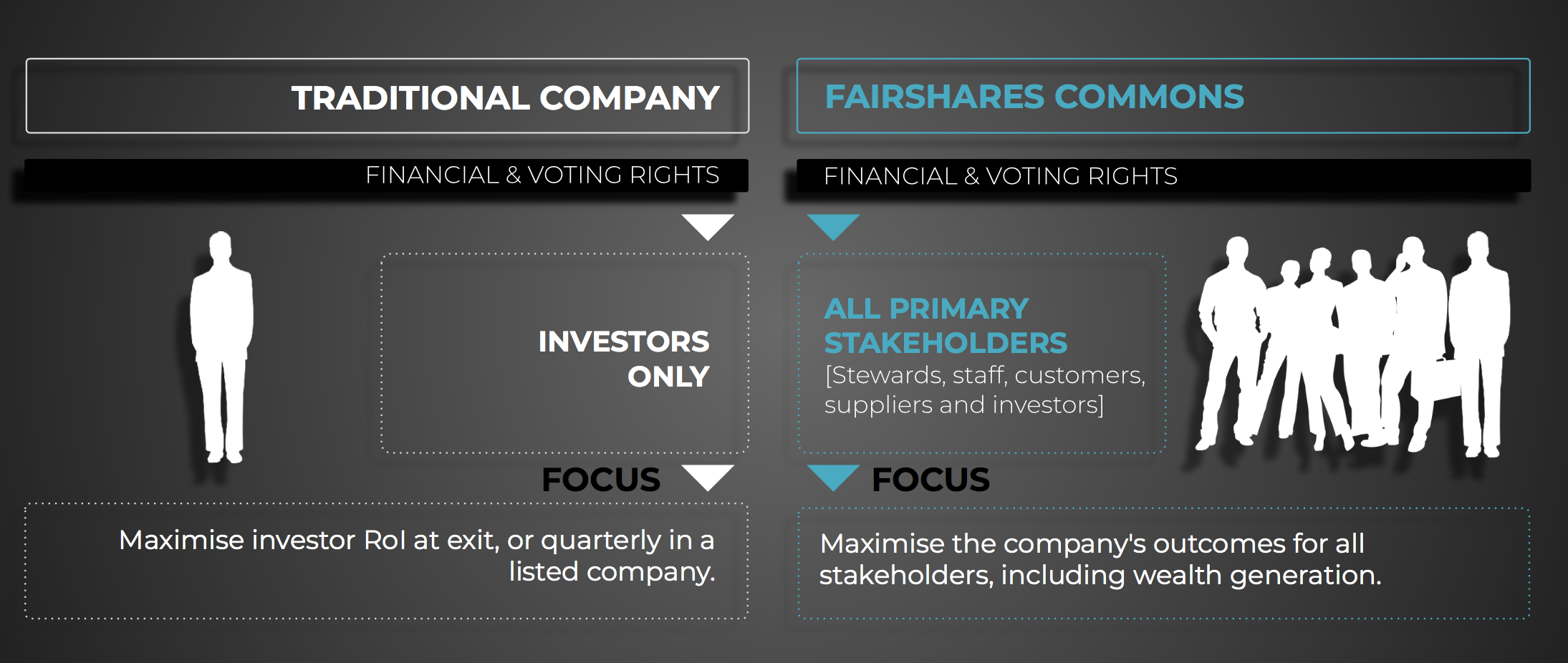

The relationship between organisations, investors and all other stakeholders.

So many decisions are taken to meet the short-term investor-driven financial goals even though almost everyone, including most investors, want to hit the long-term goals. Like having a community we are at home in, forests to walk in, and everything else that makes life life.

Is money evil? No; it’s just a source of power. We choose what we use that power for. Our current business structures make it hard for us to use that power wisely. So we need urgently to release a completely new version. The company 2.0, you might say.

A company form that is designed to use the power of all capitals for good; designed to multiply, i.e., regenerate all capitals; not just financial.

The FairShares Commons builds on the work of many sources; as covered here it is the integration of the FairShares work of Prof. Rory Ridley-Duff and the Free / Commons company developed by myself.

What is

fairshare commons?

FairShares Commons incorporation is vital for any regenerative, circular economy, impact or any triple bottom line company to work properly, because only this kind of incorporation gives all of the inter-independent companies and stakeholders the long-term systemic trust they need to invest in the whole circle.

Want more?

Podcasts & Videos

If you enjoy listening to podcasts, and want to hear Graham explaining the full why, how and what, then listen to this podcast. Graham is being interviewed by business students from Roskilde University — who are writing a guest contribution to the book.

How

This works because voting in each other’s general meetings, having a share in the wealth generated across the ecosystem, and common people practices delivers deep structural trust. Not the superficial trust of contracts.

FairShares Commons is a powerful platform to make business ecosystems work properly. .

It is the basis for the anti-fragile, regenerative platform economy we need now.

We already have early success stories. Companies like Evolutesix, UniOne, LocoSoco and Coopexchange are all using variants of the FairShares company, and UniOne is the current best example of a FairShares Commons.

Let’s work together to change the apartheid foundations of business fast enough to create the regenerative economy society needs now.

FairShares Commons startup ecosystems address the systemic reasons why 90% of startups fail; and why business in general, especially the triple bottom line, circular economy, and impact investing has fallen short of delivering against expectations. A FairShares Commons Ecosystem naturally creates Zebras, i.e., companies that have a healthy impact to society and the planet, and grow as nature does: in balance across the ecosystem.

Such an ecosystem has:

- All stakeholders engaged in the company in maximising it fulfilling its purpose without compromise.

- Most Zebras deliver solid growth (vs. few Unicorns) because they are inter-independent, both collaborating and competing to maximise the whole ecosystem’s RoI and Impact.

- All levels of conflict turned into results, not losses.

From hopelessness & powerlessness to

Hope and Power!

-

Making a company a property that serves first the needs of investorto freeing it to provide for the needs of all stakeholders including our environment.

-

From financial capital dominanceto equitability of all capitals including natural and human capitals.

-

From a static hierarchy of money and ego dominanceto an agile, adaptive hierarchy.

-

From unhappy, unhealthy, unproductive workplacesto happy, healthy, productive workplaces.

-

From companies where you seldom can do what is long-term rightto companies where you usually do what is long-term right.

-

From just getting a salary each monthto getting a salary and a share of the wealth generated.

-

From just buying or supplying products and services to the companyto being a full partner, buying, supplying and sharing in the wealth generated and governance decisions.

-

From thin circular economies based on fragile contractsto deep circular economies based on inter-independent governance in each other’s companies.