Summary:

Buying votes is illegal when electing national governments. Yet governance rights in companies are bought through buying shares. Previously OK for business success, it falls short today.

Because success means far more than just profit; requires far more than just money; and deserves risk management by a far more diverse group than just the financial investors.

Wordcount: 1000 Reading time: 8 minutes

Engaged, productive knowledge workers

“What is a company for?” asked Charles Handy in 1995. The simplest answer is so close that we no longer see it.

Often the answer is “maximise total shareholder return.” This is drives better success if you change one word. Shareholder changes to Stakeholder. This change generates profitable sustainable cashflow, especially for knowledge based businesses.

Maximising Stakeholder return drives sustainable business success because it motivates all to risk investing all their capitals. Intellectual, time, relationship, etc. capital as well as financial capital.

80% or more of the value of many companies today is in intangible assets, created by the investment of non-financial capitals by stakeholders other than investors. Turning these assets to value hinges on the knowledge worker. But ….

“The productivity of knowledge work – still abysmally low – will predictably become the economic challenge of the knowledge society. ”

Peter Drucker, 1995, Managing in a time of great change.

Productivity means the knowledge worker feeling completely able to share all their knowledge, and process it with others for mutual benefit. Feeling completely able to share requires trust. Trust means being able to manage risk. Risks about what will happen now and in the future if I share (invest) myself.

When all Stakeholders’ are engaged in both maximising reward and in managing the risks you drive sustainable success from all stakeholders and capitals.

For example: Someone hired to build cars knows what will happen to their output when they sign on. But knowledge workers often know long after they’ve invested all they have. If they have a vote in the long-term in company governance, they’re much more likely to risk investing discretionary time, knowledge and relationships. (The shareholder meeting kind of vote currently restricted to “one share, one vote”.)

This is true for all workers, of course. So perhaps structures more motivating for knowledge workers are more motivating for all to perform.

Motivating all Stakeholders to drive value

“There is a widespread feeling that investor demands are inconsistent with growing a sustainable business.”

Sustainable business needs these investor demands to thrive. And sustainable business needs the demands of all the other stakeholders to really thrive.

CIMA: “Rebooting Business, Valuing the Human Dimension“

“Miss Aching, regrettably you have no rights at all. you are not a leaseholder, you are not a tenant and you own no land. In short you have nothing on which rights are based.”

Baron Roland in “I shall wear midnight” by Terry Pratchett.

What’s changed for businesses heavy on knowledge work, compared to traditional manufacturing, is that knowledge cannot be used up. More, its value multiplies the more it connects with other knowledge. And, knowledge workers are simultaneously both “processors of knowledge” and the “sources” of knowledge as a resource; i.e., knowledge employees and investors simultaneously.

Many current ways of engaging and motivating knowledge workers and other stakeholders are like giving an Aspirin to cure a broken leg. The broken leg is the disempowerment created when important people have zero scope to manage the risks when they invest.

Triple bottom line anchored in the structure.

“Profit for a company is like oxygen for a person. If you don’t have enough of it, you’re out of the game. But if you think your life is about breathing, you’re really missing something.”

Peter Drucker

Risk management for all stakeholders requires voting proportional to stakeholding, not just financial shareholding. This creates the long-term trust for all stakeholders to readily invest all types of capitals. It automatically transforms CSR, the triple bottom line etc., from a voluntary add-on into a hard structural profit driver. It embeds Michael Porter’s Shared Value (8) approach. Because all the business value in people and planet are now hard-wired into the governance in balance with the profit value.

Even measured only on profit, thriving long-term means maximally motivating the investment of all capitals from all stakeholders, not just financial capital from investors.

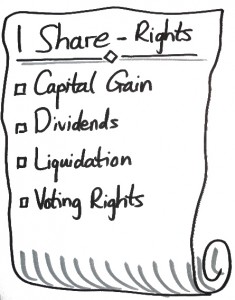

Decoupling rights means splitting the financial and voting rights usually bundled together in a single share. You create on certificate with only voting, another with only financial rights.

Decisions better for the long-term thrival come out of the broader dialogue and voting balance between different stakeholders. Better than you get today in structures where shareholders alone have a vote in an AGM.

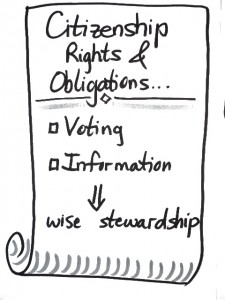

This is the structure LTSGlobal is adopting. Voting rights are earnt via many routes; financial investment, employment, intellectual investment etc. These voting rights are earnt, and are withdrawable, not tradable. So they cannot be bought, sold or transferred in any way to another. They have zero financial value, and carry zero financial rights.

This is the structure LTSGlobal is adopting. Voting rights are earnt via many routes; financial investment, employment, intellectual investment etc. These voting rights are earnt, and are withdrawable, not tradable. So they cannot be bought, sold or transferred in any way to another. They have zero financial value, and carry zero financial rights.

Investment shares end up the same in a decoupled model. They have value, are bought and sold, and bear the standard financial rights (appreciation, dividends, liquidation). And having cash at risk, invested in the company, earns voting rights.

Investment shares end up the same in a decoupled model. They have value, are bought and sold, and bear the standard financial rights (appreciation, dividends, liquidation). And having cash at risk, invested in the company, earns voting rights.

Decoupling is how nations have succeeded economically in the past century. Nations that no longer use landownership as a proxy for citizenship and the right to vote. By analogy, stakeholders in a decoupled structure become fully empowered citizens of the company.

This is the step to make companies a force for good for people, planet and profit. Going from Shareholder governance to Citizen governance. Citizens with both rights and obligations to steward the company for themselves and their descendants.

Some of you are saying, “but you need the executive hierarchy for day to day operations!” Of course; executive management and leadership stays the same.

What’s a company really for?

The answer to Charles Handy’s question is in the roots of the word company itself. Panis is Latin for bread, and so Companio is Latin for someone who eats bread with you.

A company exists to increase the ability of all the Companios to thrive. Thrive better individually because they are stakeholders of the company, sharing collaboratively in order to have more for themselves. And doing this because they fulfill the purpose brilliantly, delivering what consumers need, and rewarded with healthy, sustainable profit.

This can only happen well, can only create thrival, if all Companios are free citizens with a right to vote.

If you want to read the constitution of LTSGlobal contact me and I’ll email it to you.

References and Footnotes

Knowledge workers will be 45% of the UK employment by 2014 (2); and the number is steadily rising. Thrival depends on this, for individuals, for companies, and for the economy as a whole.

Those at the top of the “Best company to work for” ranking clearly do this job well. And the proof is there; the top 40 have a 16% annualised return vs. only 4% for the S&P 500(7).

- As described by, for example, Clayton Christensen in “The Innovator’s DNA.”

- The Work Foundation report: www.theworkfoundation.com/downloadpublication/report/65_65_defining%20knowledge%20economy.pdf

- See the CDF framework of Otto Laske. www.interdevelopmentals.org/methodology-cdf.php

- Multi-stakeholder companies and structures: Jim Brown, www.bakerbrown.co.uk/bbaequity.pdf

- Conscious Capitalism: www.consciouscapitalism.org

- Business as a Force for Good: www.tomorrowscompany.com

- Richard Barrett, slide 6, shows how companies at the top of the “best places to work” ranking deliver four times more capital gain than the S&P500 over the past decade. http://www.slideshare.net/BarrettValues/the-values-driven-organisation-v-10

- Michael Porter. https://archive.harvardbusiness.org/cla/web/pl/product.seam?c=24811&i=25967&cs=e3c4e5ddc7e9cb91d18872a098ee63b6