Length: 1000 words

“What is a company for?” asked Charles Handy in 1995 1. Traditionally “maximise total shareholder return .2” A company can therefore be viewed as a multiplication machine. A tool to multiply the capital of its investors. (This extends this blog on Multi Stakeholder voting.)

.2” A company can therefore be viewed as a multiplication machine. A tool to multiply the capital of its investors. (This extends this blog on Multi Stakeholder voting.)

Three changes of the past decades require a fundamental re-design of this tool:

- Capitals and Consumables are changing.

- The emergence of “Organisation Man”

- The rise of the knowledge worker

1 Capitals and Consumables

A company multiplies capital by transforming consumables. It takes low cost consumable input of low usefulness and transforms them to consumable output of high usefulness at high price and waste of low or negative value.

A company does this well when it is a tool with the right design for the specific capitals and consumables it is being asked to multiply.

Capitals and Consumable are defined as:

- Capital is a catalyst, good for any company, at least conserved.

- Consumable is transformed, specific to one industry, in some sense limitless, to be used up and transformed.

Which inputs and outputs are classed as capitals or consumables form the boundary conditions defining how the tool is to be designed.

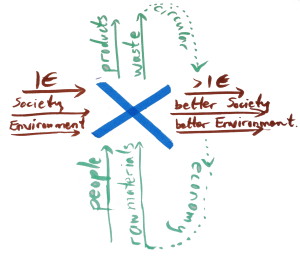

The big assumption remains unexamined, is that the only capital to conserve and multiply by the tool is financial capital. All else is either explicitly defined consumable, or implicitly treated as a consumable. Many of the issues today are consequences of this assumption.

The environment, society, and human beings are in some sense classed as consumable inputs. In essence, the tool is not designed to conserve and multiply them. This assumption only holds in the small business world of the past, where they were effectively infinite.

Today it is clear that the environment, society, and human aspects such as intellect and spirit ought to be treated as capitals, not consumables. To be at least conserved, and ideally multiplied, by all businesses.

This requires a fundamental re-design of the tool “company” itself. Trying to make the tool do something contrary to its design purpose, through force of will or legislation, is as futile as attempting to make a cactus do other than maximally accumulate water.

If a sport is designed to only use feet, you get football; only hands, you get basketball; and both hands and feet, you get rugby.

The locking together of financial capital rights and governance rights into a single vehicle, the share, creates a tool perfectly designed to multiply only financial capital and treat all else as consumables. Like asking footballers to play basketball but only use their feet.

The tool “company” is a set of human beings and relationships; agents with interactions between them. So we need to re-design which agents interact, and how they interact.

If you have multiple capitals to conserve or multiply individually and collectively the tool must deliver a stable state where no single capital or agent can gain more at the expense of another, nor can the collective outcome be increased. Called a “core outcome”3

Our current hard-wiring of financial capital rights and governance rights is a design unable to deliver a core outcome across financial and non-financial capitals.

2 The emergence of “Organisation Man”

Next consider the internal processes of a company seen as a multiplication tool. These hinge on individual human beings and the relationships between them4. So for the tool to have the highest multiplication factor and be sustainably resilient it must be designed to maximally deploy the strengths of normal human beings. And be minimally harmed by their weaknesses.

It needs to be fit for normal human beings. With typical blends of motivations, developmental levels, skills and weaknesses. (A Requisite Organisation5)

At the heart of this is each living organism, including human beings, is itself a multiplicator. Perhaps the basic capital of a living organism is the gene pool, social relationships and environment; and the consumables are food, water etc.

Living organisms are tools designed to conserve and multiply of their capitals, by maximising the acquisition and transformation of their consumables.

We can react to what this leads to in harmful human behaviour in organisations by raging against it; by using laws and punishment to restrict it; or most effectively by redesigning organisational context, process and relationships to be fit for human consumption. Maximally align individual human nature with the organisation’s nature as a multiplier.

Organisations as a human “habitat” are only a few generations old. And it’s only in the past few decades that they became the place where most humans spend most of their time.

3 The rise of the knowledge worker

Leading to the rise of the organisational knowledge worker and their ability to interact as the pivotal agent-interaction element in designing companies to multiply. Most of today’s companies are highly dependent on the knowledge worker. Motivating6 this knowledge worker means meeting their needs for Autonomy, Master and Purpose.

To transform the company into a tool to conserve and multiply many capitals, in a world where most people work in organisations, based heavily on knowledge workers, requires at least examining and potentially changing foundational assumptions. Make an object of reflection and conscious design those assumptions we are typically subject to.

One of these is the current hard-wiring of voting rights to financial capital.

I propose that treating as a capital the knowledge worker’s intellectual and relationship contribution; treating as a capital the broadest aspects of society and environment; will enable us to use business as a force for good.

And that this means all capitals require their respective investors to have the mix of both voice and power (strategic, not day to day) needed for the tool’s design to deliver a core outcome. One where none of the financial, social, environmental etc. capitals can be made any bigger at the expense of any other investor of a capital. Neither individually nor collectively.

We need to understand better what this means, partly through discussion, but more effectively by testing the hypothesis in a real company.

References

- Charles Handy, Tomorrow’s Company inquiry of the Royal Society of Arts.

- Jack Welch, http://en.wikipedia.org/wiki/Shareholder_value and quoted in Betsy Morris, “Tearing up the Jack Welch playbook” (July 11, 2006) Fortune at CNNmoney.com

- Jordan M. Barry,* John William Hatfield,** & Scott Duke Kominers† “On Derivatives Markets And Social Welfare: A Theory Of Empty Voting And Hidden Ownership” Electronic copy available at: http://ssrn.com/abstract=2134458; Roberta S. Karmel, “Voting Power Without Responsibility Or Risk: How Should Proxy Reform Address The Decoupling Of Economic And Voting Rights?” 2010

- e.g. Peter Drucker, “The Effective Executive” 2006, Harper-Collins

- Elliott Jacques, “Requisite Organisation” 1998 Cason Hall and Co. “The life and behaviour of living organisms”, Praeger.

- Dan Pink“Drive: The Surprising Truth About What Motivates Us, ISBN 978-1-59448-884-9“